FINANCING ACTIVITIES IN CASH FLOW STATEMENT HOW TO

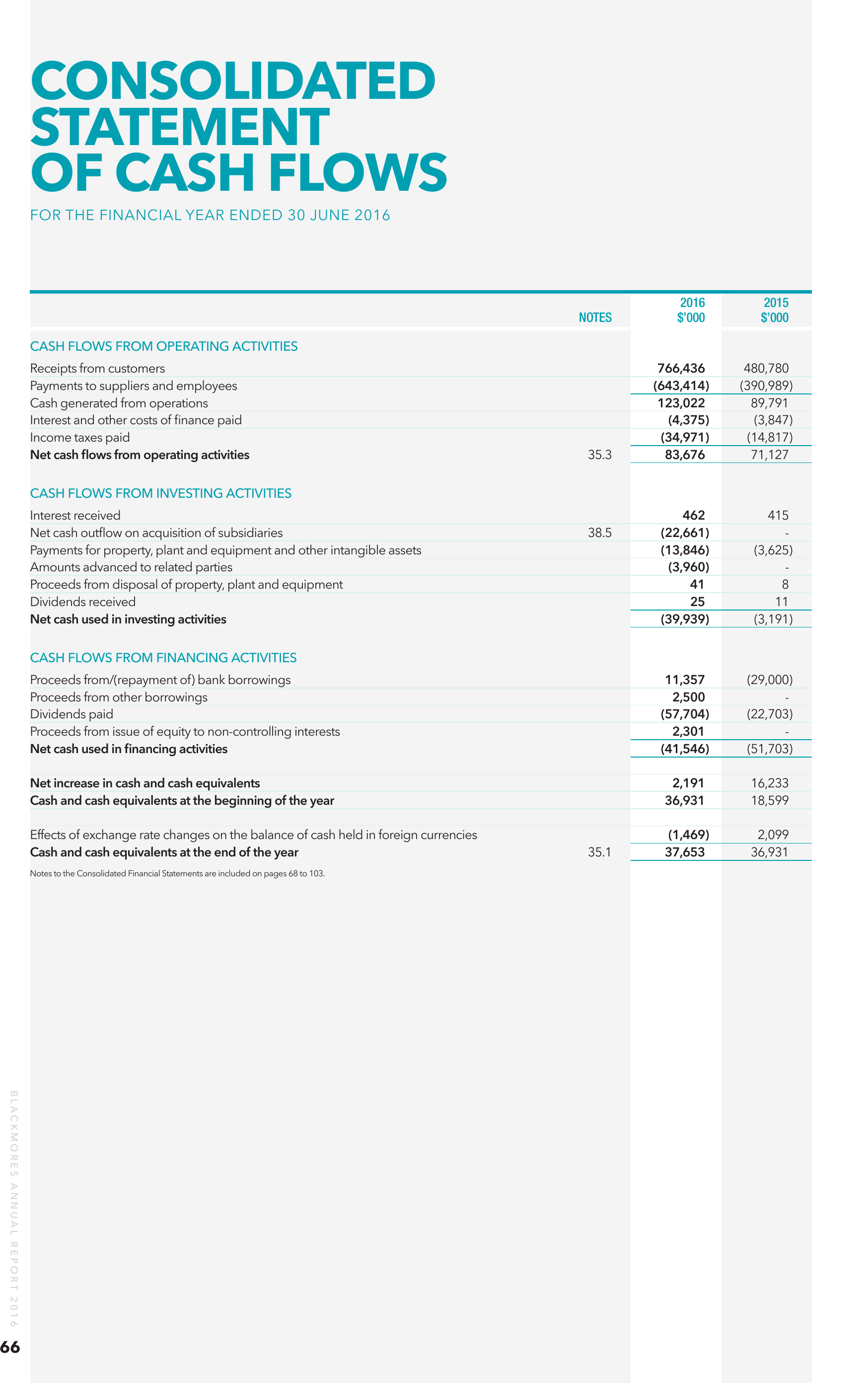

We discuss how to use cash flow information to evaluate organizations later in the chapter. The operating activities section allows stakeholders to assess the ongoing viability of the company. This section answers the question, “how much cash did we generate from the daily activities of our core business?” Owners, creditors, and managers are most interested in cash flow generated from daily activities rather than from a one-time issuance of stock or a one-time sale of land. Question: Which section of the statement of cash flows is regarded by most financial experts to be most important?Īnswer: The operating activities section of the statement of cash flows is generally regarded as the most important section since it provides cash flow information related to the daily operations of the business. Likewise, payments of cash for interest on loans with a bank or on bonds issued are also included in operating activities because these items also relate to net income. * Receipts of cash for dividends from investments and for interest on loans made to other entities are included in operating activities since both items relate to net income. Figure 12.2 "Examples of Cash Flow Activity by Category" presents a more comprehensive list of examples of items typically included in operating, investing, and financing sections of the statement of cash flows.įigure 12.2 Examples of Cash Flow Activity by Category

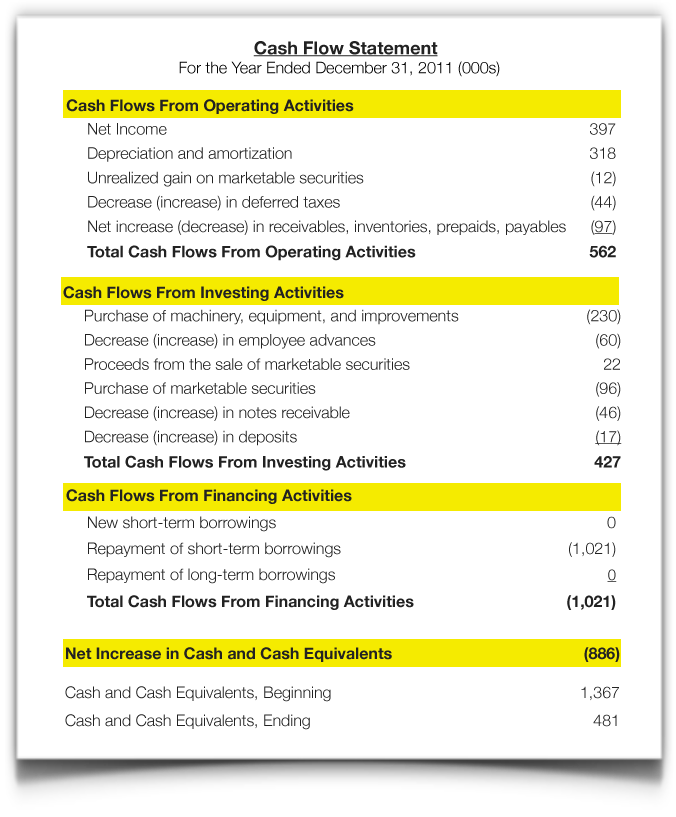

(Note that interest paid on long-term debt is included in operating activities.)įigure 12.1 "Examples of Cash Flows from Operating, Investing, and Financing Activities" shows examples of cash flow activities that generate cash or require cash outflows within a period. Noncurrent liabilities and owners’ equity items include (1) the principal amount of long-term debt, (2) stock sales and repurchases, and (3) dividend payments. include cash activities related to noncurrent liabilities and owners’ equity. Financing activities A section of the statement of cash flows that includes cash activities related to noncurrent liabilities and owners’ equity, such as cash receipts from the issuance of bonds and cash payments for the repurchase of common stock.(Note that interest received from loans is included in operating activities.) For example, cash generated from the sale of land and cash paid for an investment in another company are included in this category. Noncurrent assets include (1) long-term investments (2) property, plant, and equipment and (3) the principal amount of loans made to other entities. include cash activities related to noncurrent assets. Investing activities A section of the statement of cash flows that includes cash activities related to noncurrent assets, such as cash receipts from the sale of equipment and cash payments for the purchase of long-term investments.For example, cash generated from the sale of goods (revenue) and cash paid for merchandise (expense) are operating activities because revenues and expenses are included in net income. include cash activities related to net income. Operating activities A section of the statement of cash flows that includes cash activities related to net income, such as cash receipts from sales revenue and cash payments for merchandise.Each of these three classifications is defined as follows. Question: What are the three types of cash flows presented on the statement of cash flows?Īnswer: Cash flows are classified as operating, investing, or financing activities on the statement of cash flows, depending on the nature of the transaction. Describe the three categories of cash flows.

0 kommentar(er)

0 kommentar(er)